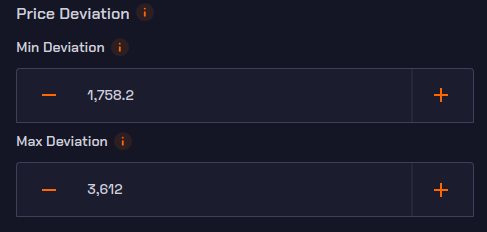

Rebalance Triggers

The rebalance triggers are the minimum and maximum price within or around the price range you set. Setting rebalance triggers provides a cushion during market swings.

In Case of Active Rebalancing

With active rebalancing, as soon as the price touches the trigger or threshold or goes out of the price range, it swaps the assets to rebalance the position.

In Case of Trailing Rebalancing

With trailing rebalancing it’s different. When you set a rebalance trigger outside the price ranges, you dictate that at what prices rebalancing of your liquidity position should happen when the current price changes. Here’s how it benefits:

It is a high-level customization that helps you minimize unnecessary losses.

It also prevents spammed rebalancing during market volatility.

As an LP, you can speculate if the market bounces back to your main range until your set trigger of resistance or support.