Market Modes

Selecting the right market mode for your intent is the first step in automating your rebalancing strategy. Market modes allow LPs to choose the direction of rebalancing giving them greater control over their liquidity. Based on the macro market trends, there are four modes that an LP can select from:

Bull Mode: In this mode, the position trails the current pool price as the asset price rises, optimizing for upward market trends.

Bear Mode: Here, the position trails the current pool price when the asset price is declining, ideal for downward market trends.

Dynamic Mode: This mode allows the position to trail the current pool price in both upward and downward directions, making it suitable for markets with little to no clear trend.

Static Mode: In this setting, the position remains fixed and does not trail the changing prices of the underlying assets, offering a more stable approach.

For a deeper understanding of these market modes, see them in action via the following examples.

1

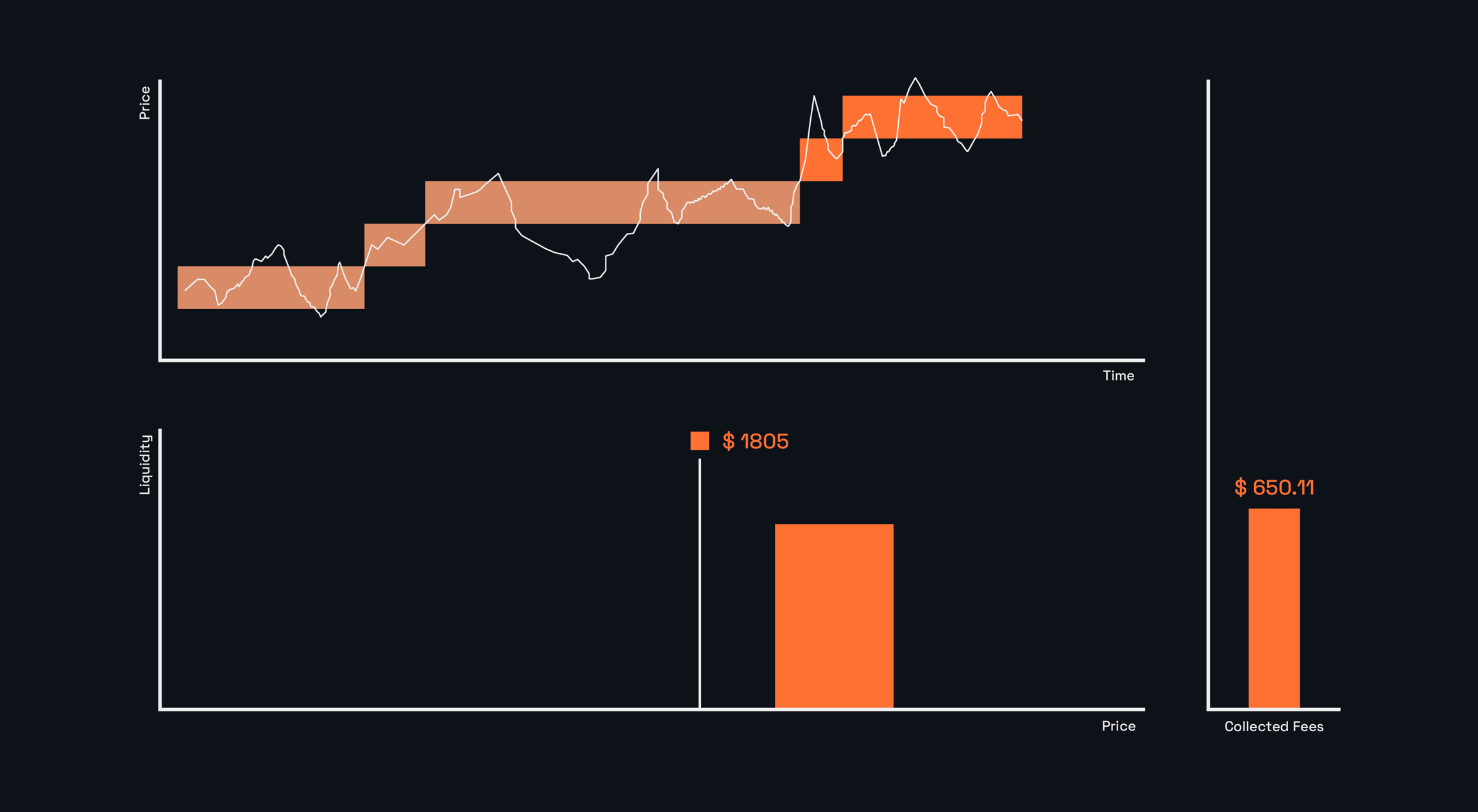

Bull

Best for bull market. This mode functions like a dynamic range order that follows the price of the tokenB asset up.

Rebalance will happen on the right side of the price. This strategy is for LPs who expect ETH to go up.

2

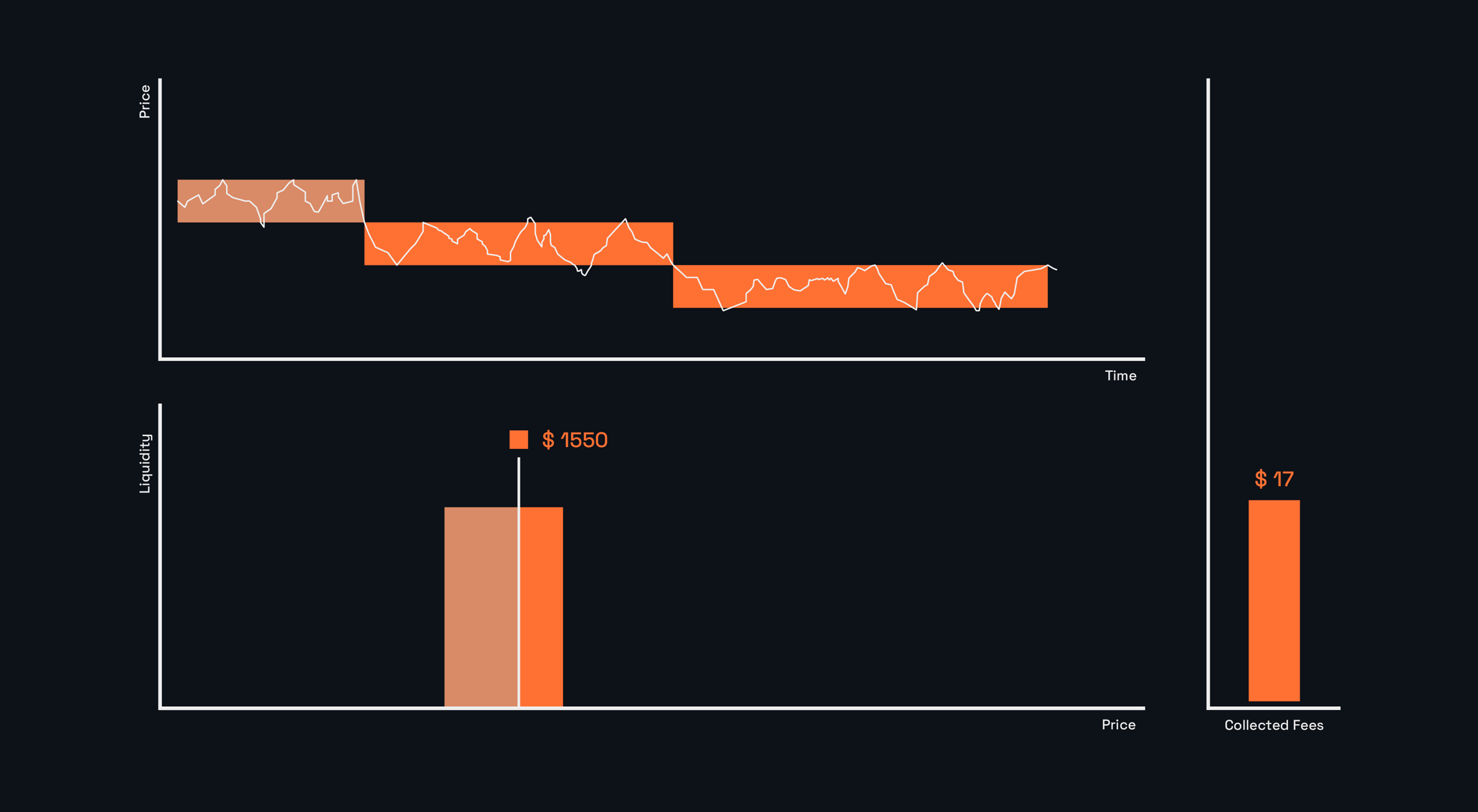

Bear

Best for bear market. This mode functions like a dynamic range order that follows the price of the tokenA asset up.

Rebalance will happen on the left side of the price. This strategy is for LPs who expect ETH to go down.

3

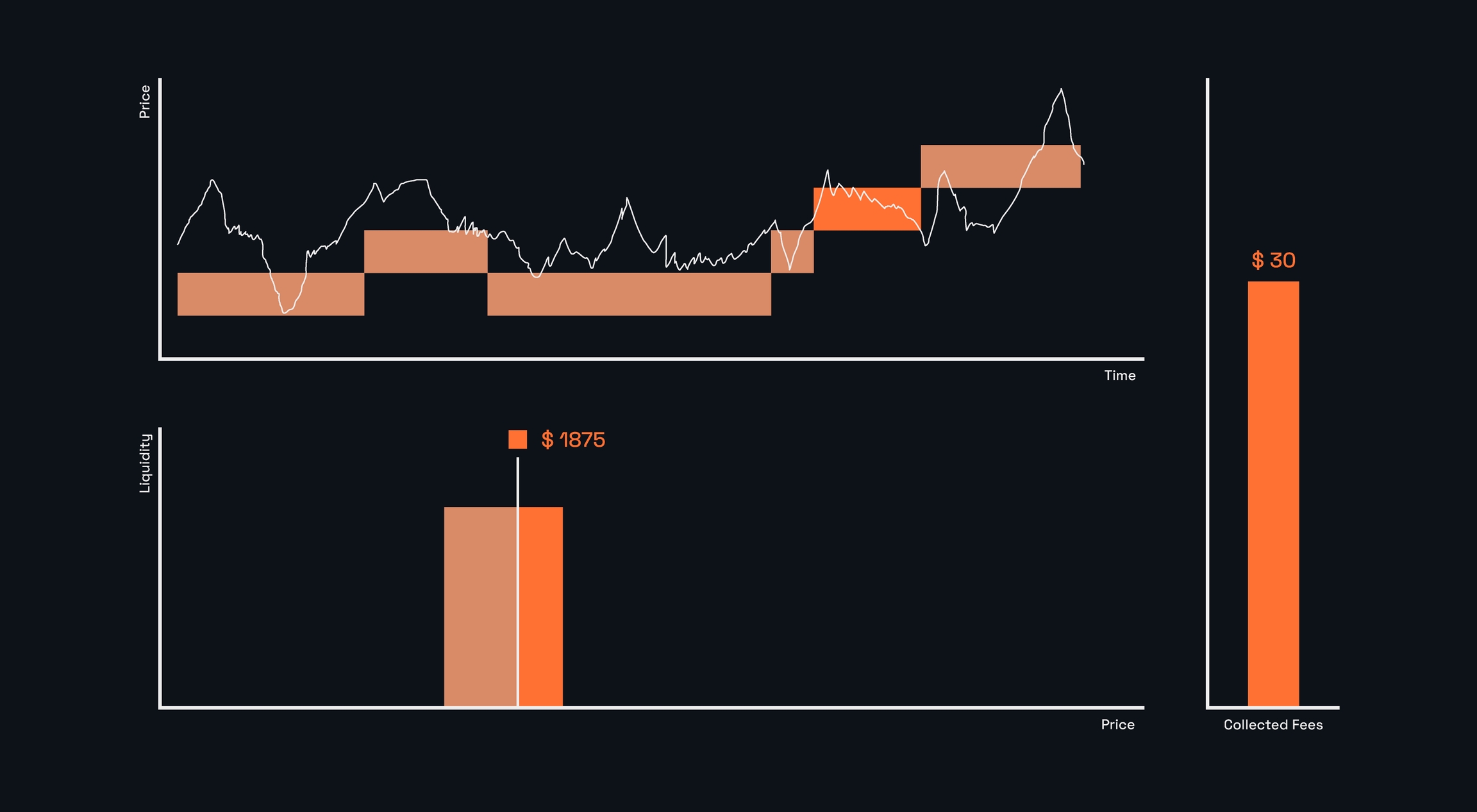

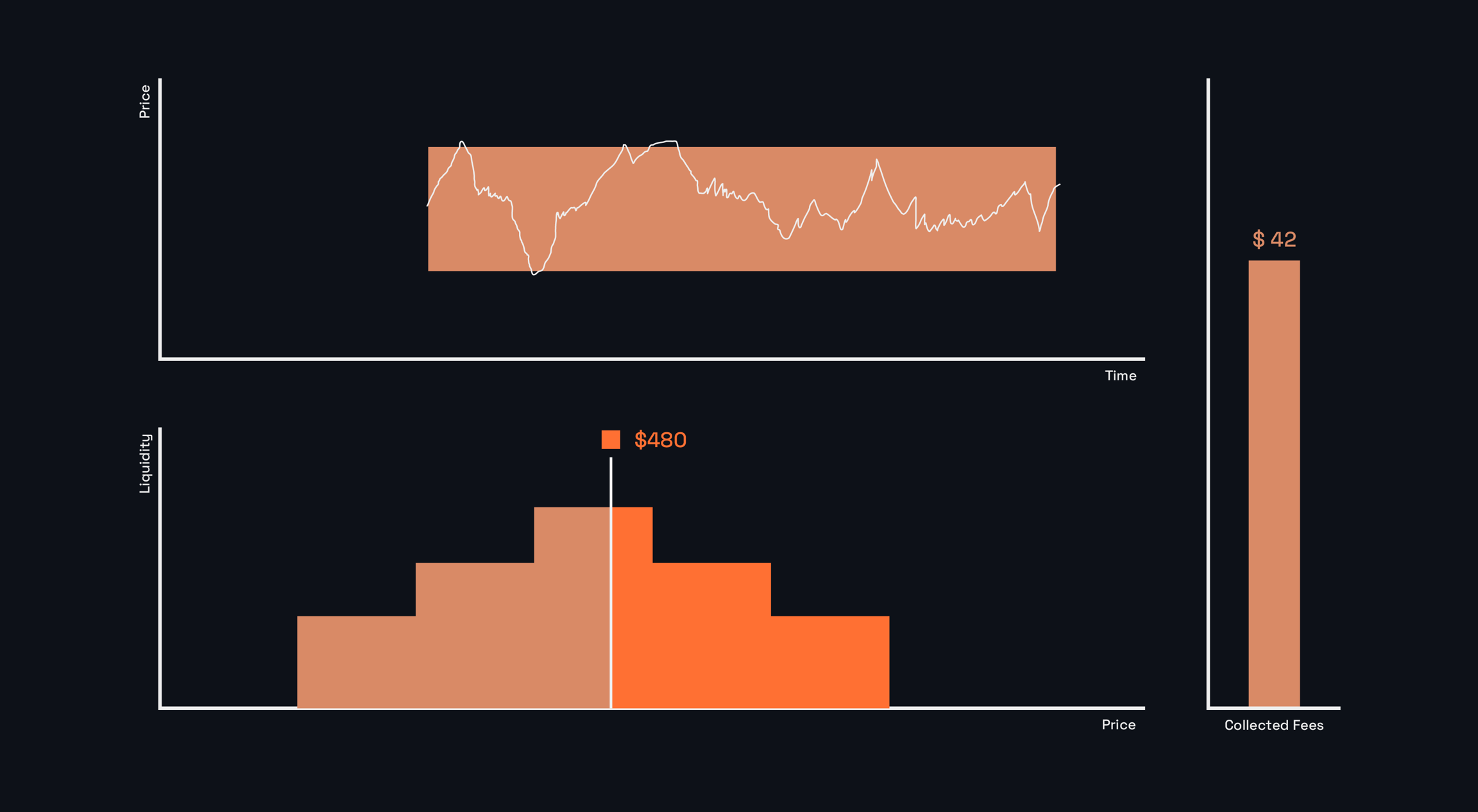

Dynamic

Best for sideways (volatile) market. This mode functions like a dynamic range order that follows the pool price right and left, keeping liquidity as active as possible.

This is how ALMs work, best for volatile markets with no clear direction.

4

Static

Best for advanced liquidity strategies. This mode features static ticks that you can use to define your own custom liquidity strategy.

Static liquidity used for building more sophisticated LP strategies.

tokenA = USDC

tokenB = ETH

Last updated