How to Manage Your Strategy

This is a guide to all the features you will come across on the A51 app while managing an LP strategy.

Once you land on the A51 app, connect your wallet.

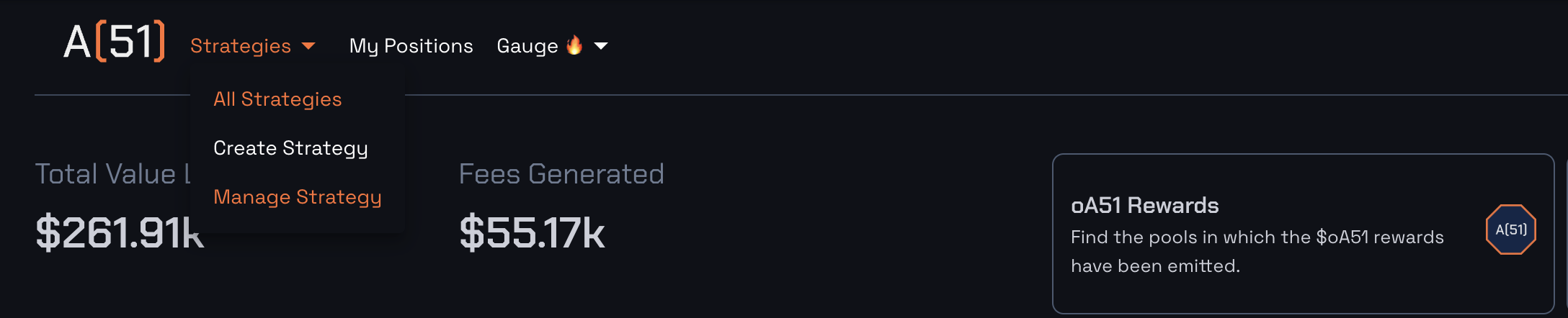

Navigate to the strategy creation page by clicking on Strategies dropdown on the top navigation bar and selecting Manage Strategy.

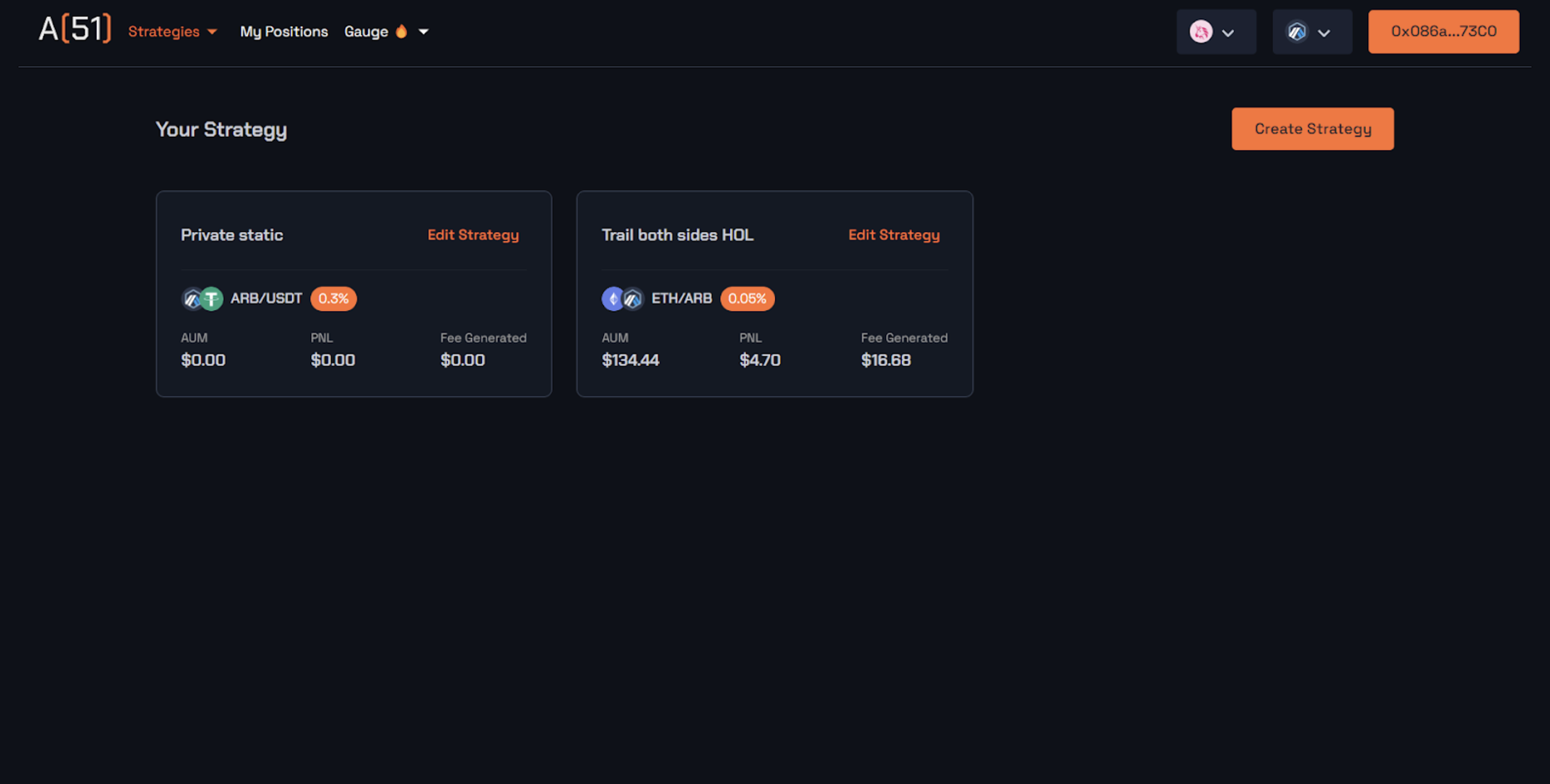

On the Manage Strategy page, you can see all your strategies with the following metrics:

AUM (Asset Under Management)

PnL (Profit and Loss)

Fee Generated

Click Edit Strategy to make changes to the strategy you want.✏️

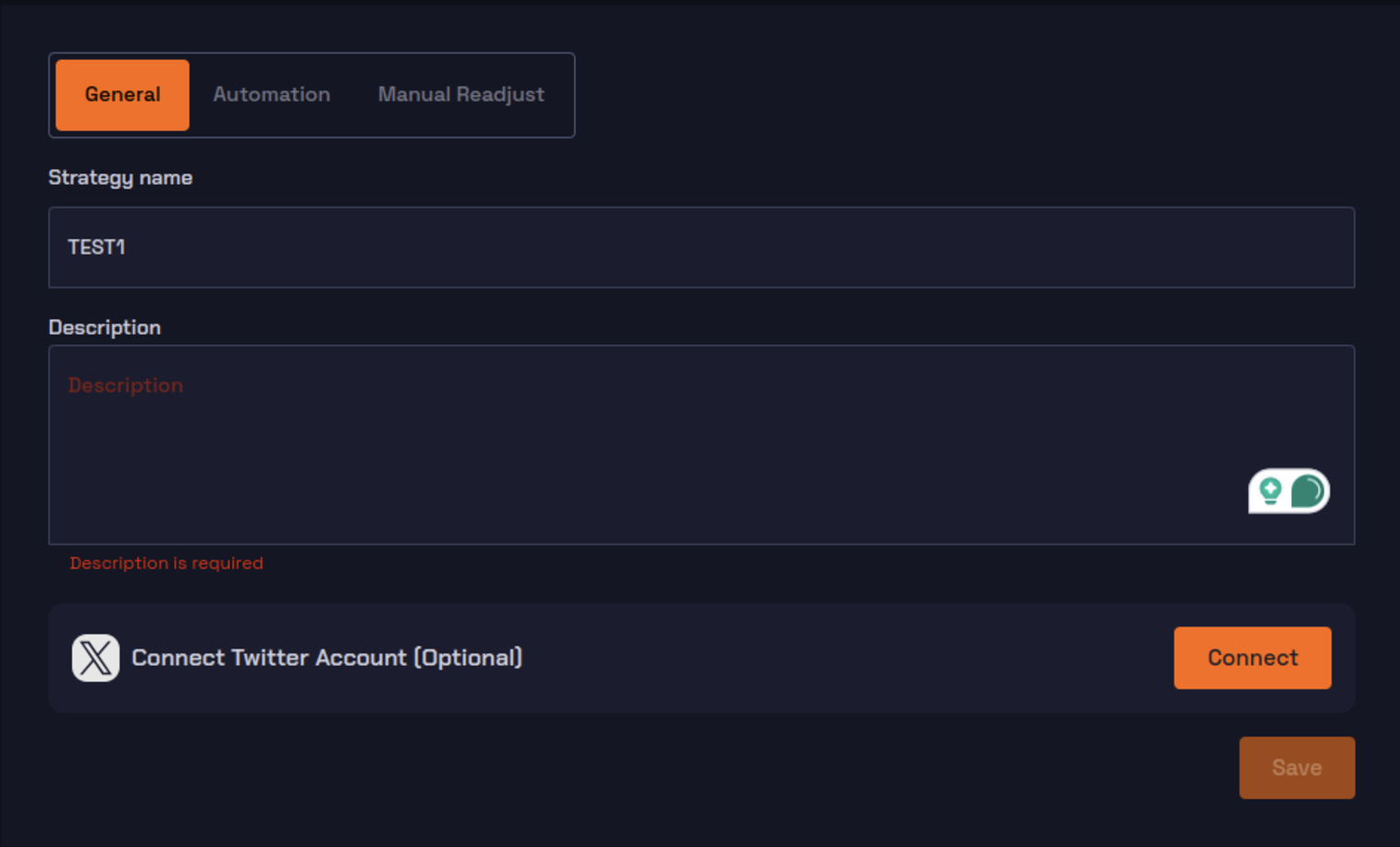

On the Edit Strategy page, you can see 3 tabs:

General

Automation

Manual Readjust

General

✏️This tab gives you 3 edit options:

Edit strategy name.

Edit strategy description.

Connect/disconnect your X account.

Click Save to proceed.

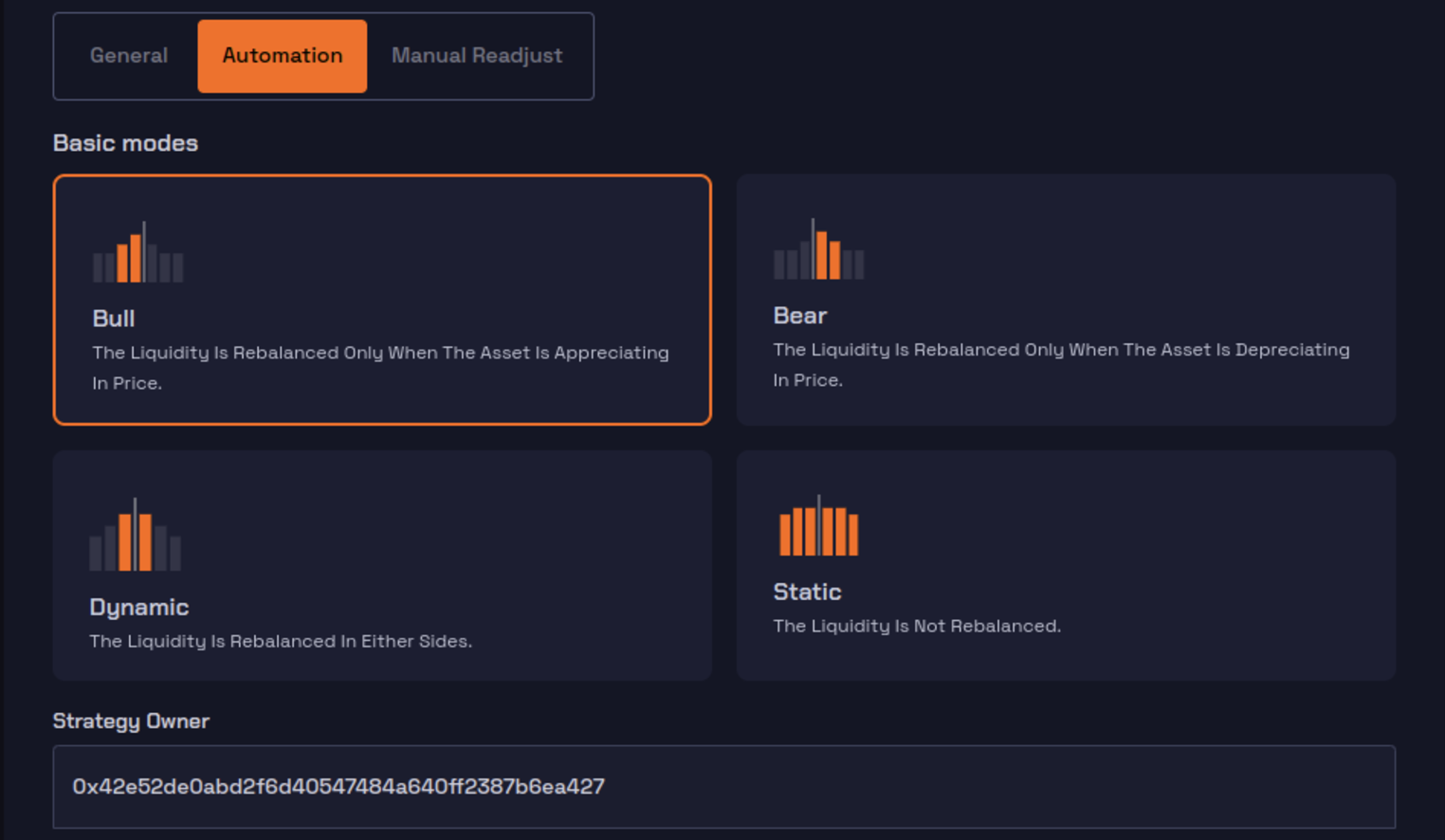

Automation

This tab has the option to edit all the features that are automated:

Market Mode

Selecting a mode is based on your market knowledge and speculation.

If you previously chose Bull mode speculating a bullish trend for an asset, for instance, but now you see a bearish trend for that asset, you can direct A51 to rebalance using the Bear mode.

Strategy Owner

You can change the ownership of the strategy by changing the wallet address.

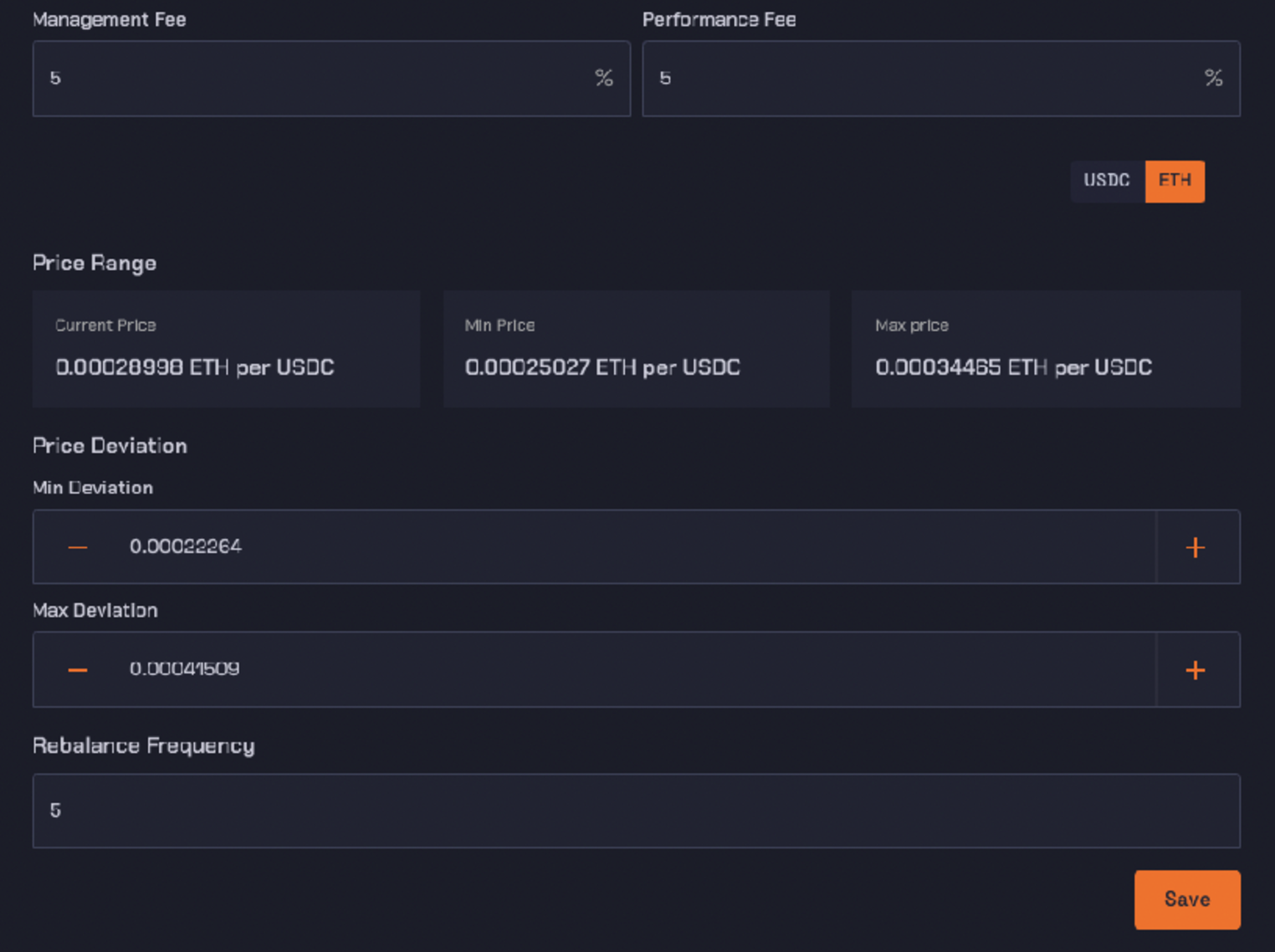

Management Fee & Performance Fee

You can change the management fee and performance fee, increasing or decreasing it based on how it is performing for you.

Rebalance Frequency

You can edit how many times you want to rebalance your liquidity position.

Price Deviation

You can make changes to the minimum and maximum price deviation using your set price range as a reference.

Click Save to proceed.

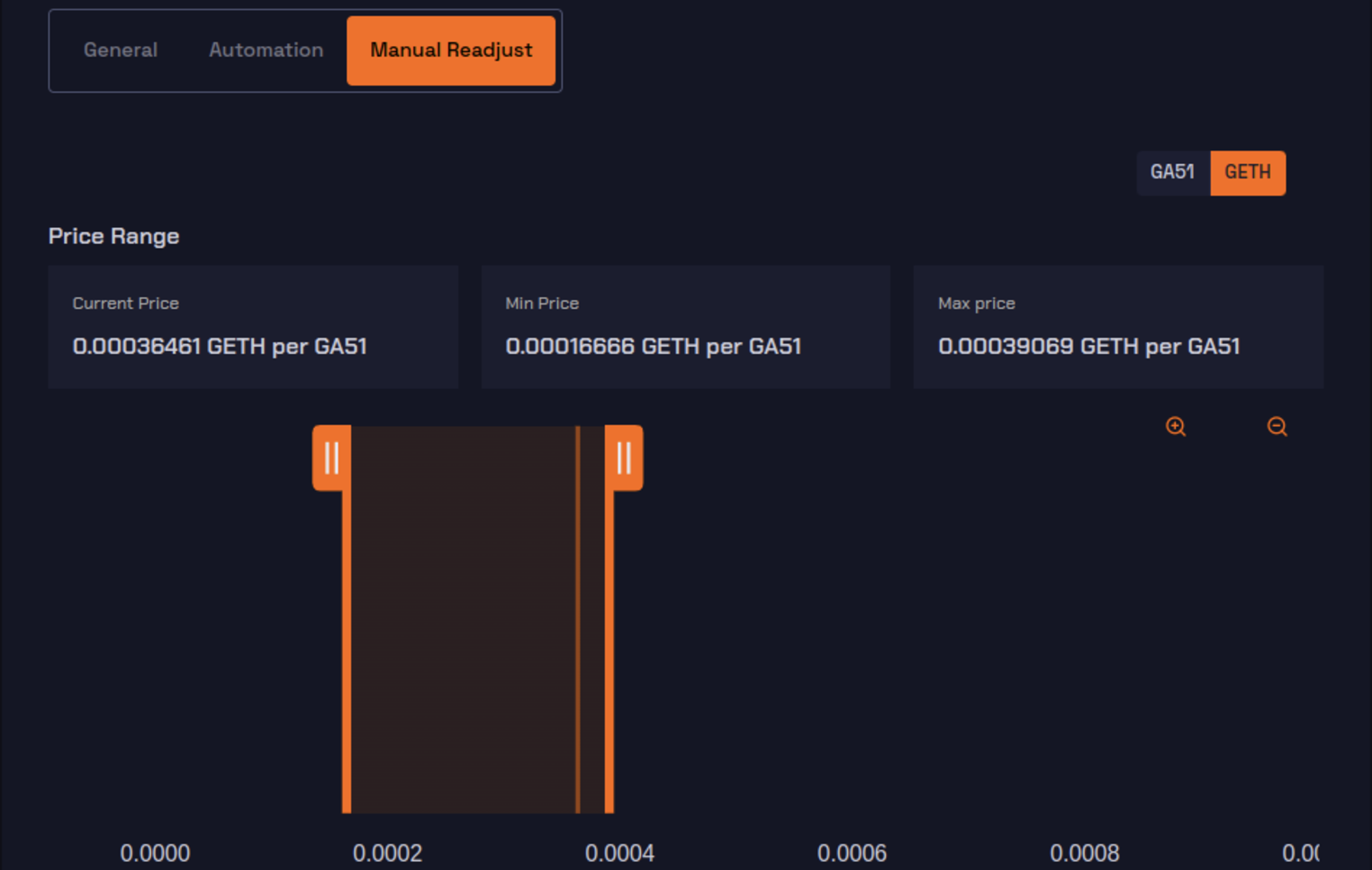

Manual Readjust

This tab has the option to edit all the manually adjusted features:

Price Range

You can manually readjust the price range of your liquidity position either on the liquidity graph or edit the numbers below.

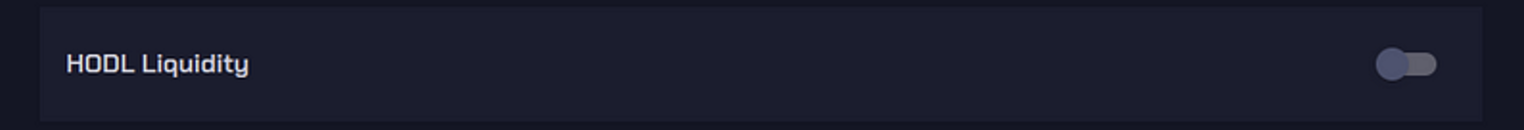

HODL Liquidity

If you neither want to withdraw your liquidity nor want to keep it active, you can HODL (hold) it.

It means your liquidity is in the protocol in a dormant state. You can withdraw your HODL liquidity or make it active again using a toggle.

Following are the possible scenarios why would you need to HODL liquidity: 👉🏼When the PnL is way more negative in the liquidity as compared to holding it for a temporary period of the low-volume market.

👉🏼When the liquidity is completely one-sided and the current price is too far ahead, running a rebalance will inflict more loss on the capital due to the conversion of impermanent loss to permanent loss.

👉🏼When you would like to tweak the strategy spreads and don’t want the changes to be directly reflected on the LPs’ capital before they are satisfied with the configurations of the strategy.

👉🏼In the future, with the Exit Strategy feature, through exit price base strategy, a strategy creator can create a sequence in which the LPs’ capital will be HODLed automatically at a set trigger price.

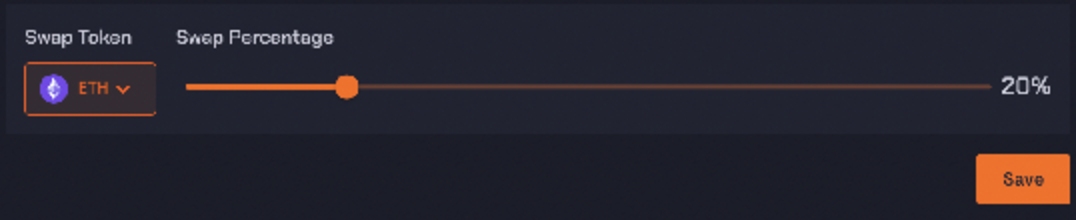

Swap Token

You can adjust the ratio of tokens in the position by manually swapping the tokens in any proportion.

Click Save to proceed.